Since 1981, Harvard Business Services, Inc. has helped form 410,569 Delaware corporations and LLCs for people all over the world. The HBS Blog offers insight on Delaware corporations and LLCs as well as information about entrepreneurs, startups and general business topics. We also recommend putting a repeating reminder on your calendar because even if you don’t receive a reminder notice, it’s still your responsibility to pay the tax every year. You will receive an email confirmation from the state showing that you have made the payment successfully. Delaware LLCs do not have to file an Annual Report (like Corporations do).

When Is The Delaware Franchise Tax Due Date?

This type of company does not pay the standard annual Delaware Franchise Tax, but must still file and pay the annual report fee of $25 per year. A corporation with 5,001 authorized shares or more is considered a maximum stock https://www.accountingcoaching.online/can-a-company-s-working-capital-turnover-ratio-be/ corporation. The annual report fee is $50 and the tax would be somewhere between $200 and $200,000 per year, as illustrated below. A corporation with 5,000 authorized shares or less is considered a minimum stock corporation.

- Delaware Franchise Taxes for corporations are due by March 1 of every year.

- The annual Franchise Tax is imposed by the State of Delaware and varies with the size of your business.

- Paying a franchise tax is a legal requirement for business incorporated in the state of Delaware.

- Harvard Business Services, Inc. guarantees your annual Delaware Registered Agent Fee will remain fixed at $50 per company, per year, for the life of your company.

Is My Delaware Franchise Tax the Same As My Annual Registered Agent Fee?

The limited partnership (LP) Franchise Tax is also due by June 1 of every year. If the tax is not paid on or before June 1, the state imposes a $200 late penalty, plus a monthly interest fee of 1.5%. We recommend paying your Franchise Tax early (you can begin paying in February) to avoid any late fees. Many people pay this tax in April, since they’ll be paying other taxes as well at that time. Late payments incur a penalty fee automatically included in the franchise tax notice, regardless of the circumstances.

comments on “Delaware Annual Franchise Tax”

Owners of multiple corporations will need to pay Delaware Franchise Tax for each entity separately as each entity is required to file an annual report. Failing to pay your franchise tax by March 1st for corporations or June 1st for LLCs will how to post entries to the general ledger result in a late penalty and interest. After missing the deadline, you’ll need to pay a $200 late fee with cumulative interest each month. Paying a franchise tax is a legal requirement for business incorporated in the state of Delaware.

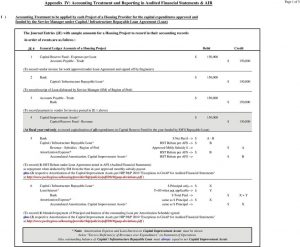

Two Methods to Calculate Franchise Tax for a Maximum Stock Company

The Delaware annual report fee is $50 and the tax is $175 for a total of $225 due per year. The Delaware franchise tax amount varies, depending on the type of company. The total cost of franchise tax is a combination of the actual taxes due and the annual report fee. Delaware limited liability companies (LLCs) owe franchise tax by June 1 of each year. If the tax is not paid by this date, Delaware imposes a $200 penalty and a 1.5 percent interest fee each month. The Delaware Franchise Tax for a corporation is based on your corporation type and the number of authorized shares your company has.

Corporations must complete an annual report along with their Delaware Franchise Tax payment. Corporations, LLCs and LPs are taxed in arrears, meaning the tax due by each due date is for the previous calendar year. The franchise tax is due even if the business didn’t conduct any activity or lost money. If your company is no longer operating, it’s important to close your Delaware business and end these fees.

The total cost of the corporation’s Delaware Franchise Tax consists of an annual report fee and the actual tax due. If the Delaware Franchise Tax calculation uses the assumed par value capital method, the gross assets and issued shares are also to be listed. If you decide to pay your Delaware Franchise Tax for a corporation with us over the phone, the annual report would need to be separately submitted to us by email, fax or mail. Delaware corporations or Delaware LLCs that are actively conducting business need to stay compliant with the Delaware Division of Corporations to keep a business in good standing. Filing the annual report and paying the franchise tax as soon as possible help you avoid frustration and delays with other time-sensitive filings.

The Delaware Franchise Tax has no bearing on income or company activity; it is simply required by the State of Delaware to maintain the good standing status of your company. The Assumed Par Value Capital Method is complex, but companies are welcome to use a franchise tax calculator to make the process easier. The Delaware franchise tax due date varies, based on a few different factors.

The Franchise Tax for a Delaware LLC or a Delaware LP is a flat annual rate of $300. Read on to find out how much you’ll pay, or visit our Delaware Franchise Tax calculator app for a quick answer. After you form a Delaware LLC, you will have annual requirements to keep track of.

This method is calculated using the number of authorized shares in the company. If the tax is not paid by this date, Delaware imposes a $200 penalty, as well as a 1.5 percent interest fee each month. If a company is not operated in Delaware, no accounting, income tax information, or manager or member information is required by the state, and the company isn’t required to pay Delaware income tax. The company’s income or activity has no impact on the franchise tax; it is required to stay in good standing. However, a “franchise tax” doesn’t necessarily mean that the company is part of a franchised business.

Your account will also be penalized at 1.5% interest for every month it remains unpaid. If you need help with Delaware franchise tax for your LLC or other company, you can post your legal need on UpCounsel’s marketplace. The State of Delaware allows you to pay the lower of the two Delaware Franchise Tax calculation methods. Therefore, if you receive a tax bill for tens of thousands of dollars, it may be in your best interest to try calculating your Delaware Franchise Tax with the assumed par value capital method. Select your method of payment (most people use ACH or credit card), then enter your payment, billing address, and contact information.

As your Registered Agent, we will send you tax reminders both by mail and email, well in advance of the due date. We offer a tax filing service for a small fee in addition to your Franchise Tax amount. For a discounted rate you can submit your Delaware Franchise Tax payment via our online Franchise https://www.simple-accounting.org/ Tax form. The online fee will vary depending on when the online payment is submitted. Our annual Registered Agent Fee is $50 per year, and is due on the anniversary month of the formation of your company. The term “Franchise Tax” does not imply that your company is a franchise business.

However, they have to pay a flat-rate Annual Franchise Tax of $300 each year. Harvard Business Services, Inc. guarantees your annual Delaware Registered Agent Fee will remain fixed at $50 per company, per year, for the life of your company. If you need assistance in obtaining a Certificate of Good Standing, we can help you receive your certificate in two business days or less.